Finance Dashboard

Live Monitor

Live Monitoring Panel

Bot activity will appear here

Live Pairs

Trading Bot Monitor

A production-ready trading market monitoring system designed to analyze financial markets in real time, identify institutional-style price patterns, and notify the trader when high-probability setups occur.

Overview

This project is a container-friendly, cloud-compatible monitoring engine engineered for reliability rather than trade execution. It focuses on detecting institutional price delivery patterns and providing actionable intelligence to traders.

The system operates by continuously analyzing price data across multiple instruments and timeframes, applying sophisticated pattern recognition algorithms based on institutional trading concepts.

Objective

The primary aim is to detect Optimal Trade Entry (OTE) retracements into Fair Value Gaps (FVGs) during high-liquidity trading hours and deliver actionable alerts.

The system focuses on timing, structure, and institutional price behavior rather than automated trade placement. This approach ensures traders maintain full control over execution decisions while benefiting from systematic market analysis.

System Architecture

The monitoring system is built on a modular architecture that separates concerns and enables scalability. Key components work together to provide real-time market analysis.

Azure SQL database for OHLC snapshots and market state persistence.

Pattern detection algorithms for FVG identification and OTE validation.

Telegram integration for real-time notification delivery.

Time-based filtering for optimal trading window enforcement.

Markets & Timeframes

The system monitors a curated list of FX pairs and indices across multiple timeframes, providing comprehensive market coverage while maintaining focus on high-quality setups.

Monitored Instruments

Analysis Timeframes

This multi-timeframe approach allows higher-timeframe context while maintaining precision on execution-level charts.

Trading Session Control

Market analysis is strictly limited to the London–New York session overlap, specifically between 12:45 PM and 3:00 PM London time on weekdays.

This constraint filters out low-liquidity conditions and improves signal quality by focusing on periods when institutional participants are most active.

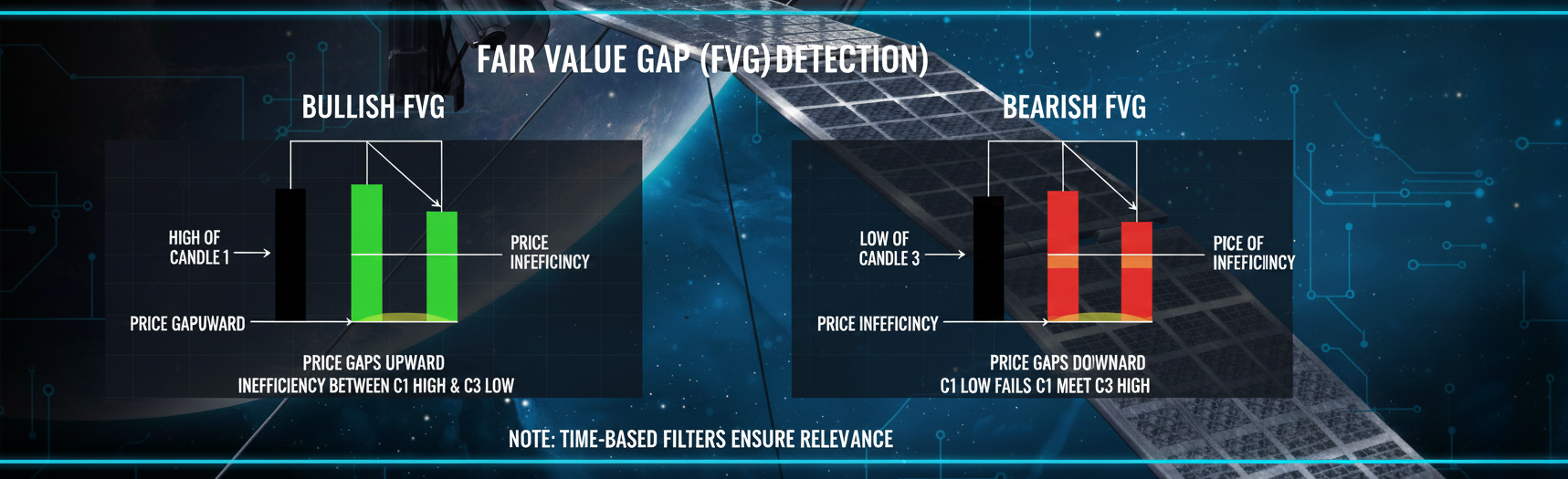

Fair Value Gap Detection

Fair Value Gaps are detected using a three-candle structure that identifies price inefficiencies created by aggressive institutional order flow.

- Bullish FVG — Occurs when price gaps upward, leaving inefficiency between the high of candle 1 and the low of candle 3

- Bearish FVG — Forms on a downward imbalance where the low of candle 1 fails to meet the high of candle 3

Time-based filters ensure that only institutionally relevant gaps are considered, eliminating noise from low-volume periods.

Retracement & OTE Logic

Once a valid FVG is identified, the system monitors price for a clean move away followed by a retracement back into the gap.

The Optimal Trade Entry zone represents the area where price is most likely to react, typically aligned with Fibonacci retracement levels between 62% and 79%.

Only retracements occurring within defined trading windows are flagged, ensuring alignment with institutional execution models.

Alerting & De-duplication

Each retracement event is uniquely tracked to prevent duplicate alerts. The system maintains state for each symbol-timeframe combination.

- Unique event tracking prevents alert fatigue

- Telegram notifications delivered in real-time

- Concise alerts designed for rapid decision-making

- Alert history maintained for analysis

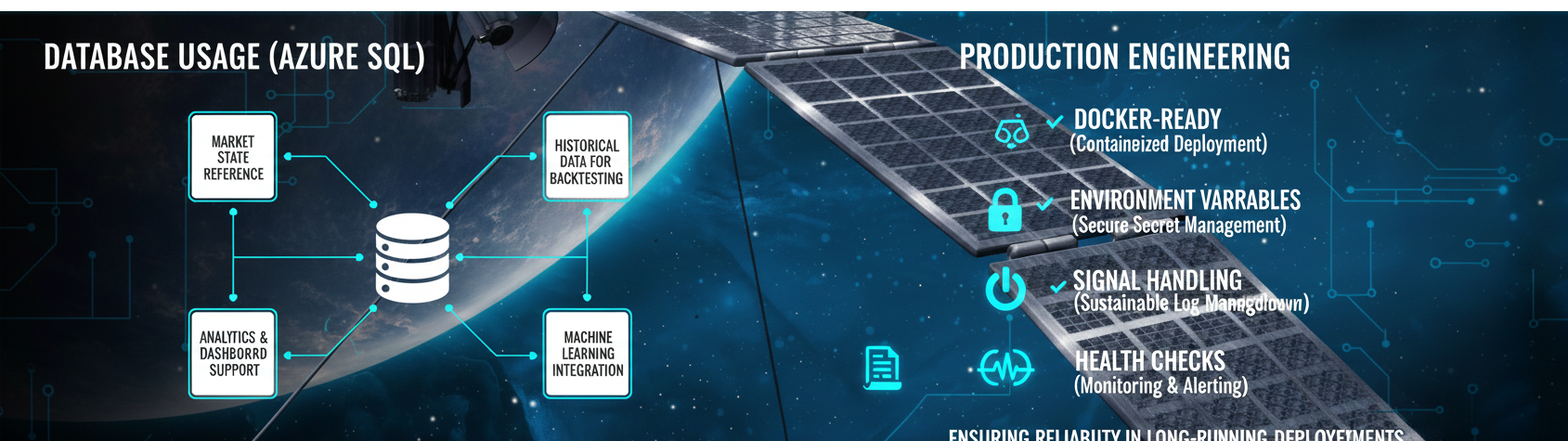

Database Usage

An Azure SQL database stores the latest OHLC snapshots and OTE/FVG states for each symbol and timeframe. This database serves multiple purposes in the system architecture.

- Market state reference for pattern detection

- Historical data for backtesting and validation

- Analytics and dashboard support

- Machine learning pipeline integration

Production Engineering

The system incorporates production-grade engineering practices to ensure reliability in long-running deployments.

- Docker-ready — Containerized deployment for consistency

- Environment variables — Secure secret management

- Signal handling — Graceful shutdown support

- Rotating logs — Sustainable log management

- Health checks — Monitoring and alerting integration

Future Enhancement

In future iterations, the project will incorporate moving average analysis combined with machine learning techniques to better capture price swings and institutional order flow.

Planned Approach

- Using moving averages (EMA and SMA) to quantify trend direction, momentum, and swing structure across multiple timeframes

- Training machine learning models on historical market data enriched with:

- OHLC price data

- Fair Value Gap locations

- Retracement behavior

- Distance from and slope of moving averages

- Time-of-day and session context

The objective is to allow the model to learn how institutional price delivery interacts with moving average structures, enabling probabilistic forecasts of swing continuation or reversal.

Rather than replacing the current rule-based logic, machine learning will act as a confirmation layer—scoring setups based on historical performance. This hybrid approach preserves interpretability while enhancing adaptability to changing market conditions.

Summary

This project serves as a robust institutional-style market monitoring engine. With future integration of moving averages and machine learning, it is designed to evolve into a data-driven decision-support system for capturing high-probability price swings.

The combination of real-time analysis, sophisticated pattern recognition, and systematic alerting provides traders with a significant edge in identifying institutional-grade trading opportunities.